Has anyone been paid? It's no secret that payday is the time to shop for items already on your wishlist. In fact, not infrequently we are tempted to shop more than we had planned. Shopping is okay, but don't make it extravagant, okay! Let's see how to control impulsive buying habits in the style of BFI Finance below.

Impulsive buying habits are actually a common trait. Moreover, online shopping access, which is now a trend, also supports this habit. Impulse shopping itself means where a person has a tendency to buy goods without planning. Usually, the desire to buy can be triggered by various things. Starting from the temptation of sales, to emotions that make someone become irrational.

If this is done occasionally, of course, no problem. But if often enough, this can harm your finances. Especially if you're being extravagant because you're tempted to buy things you don't really need.

Do you feel that your finances are broken because you spend too much on impulse? Come on, check out these tips on how to control BFI Finance's impulsive buying habits!

Symptoms of Impulsive Buying. Are You One?

Shopping Without Consideration of Benefits and Costs

If you have or often bought goods without thinking and carefully considering the benefits and financial conditions at that time, then you belong to someone who has a tendency to buy impulsively. It's good, before deciding to purchase an item, consider whether the item is really useful for us, have you compared items in other places, and of course, are you in a healthy financial condition?

Easily Tempted Promos and Discounts

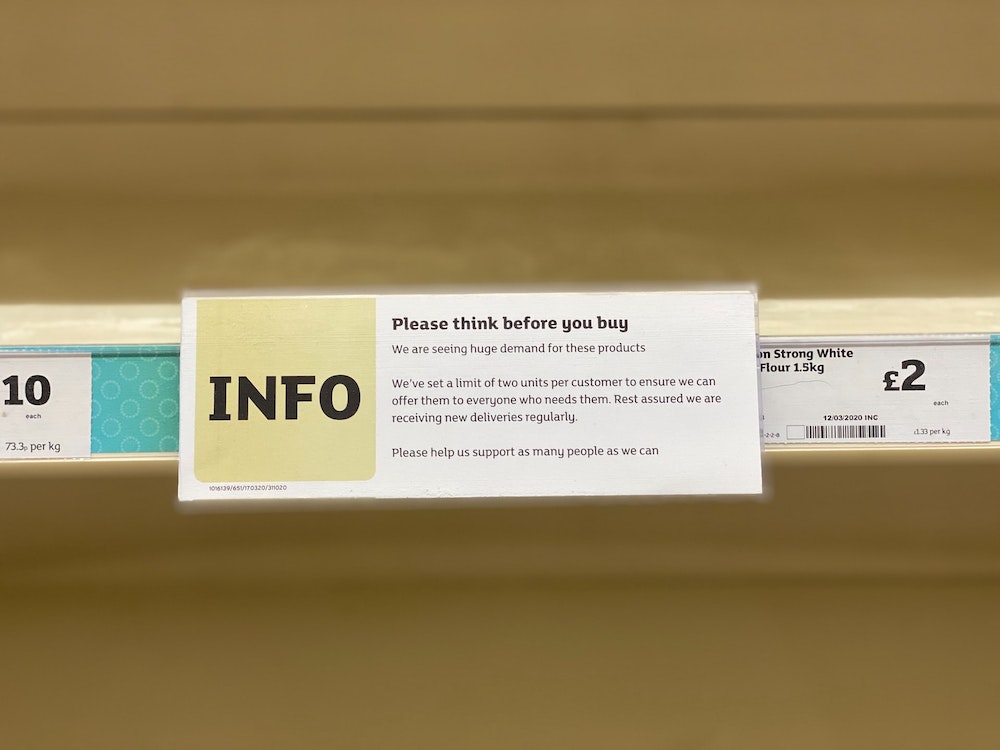

The next indicator of someone having an impulsive buying habit is that they are easily tempted by promos and discounts, but cannot take advantage of the moment wisely. There's nothing wrong with shopping for items while on promo or discount, but keep in mind the limitations. Don't be too crazy about buying discounts or promo items on the pretext that the opportunity doesn't come twice.

Love to Buy the Latest Trending Items

Don't just because of the hype, you have to give up most of your savings and even go into debt to buy new things, even though the benefits can still be obtained by the items you have at that time. Again, consider carefully before deciding to buy a new item.

Shop for Momentary Satisfaction

The next symptom of impulsive buying is when a person likes to seek instant gratification or instant gratification. Instant here intends to shop for self-satisfaction in a short period of time and may only last a matter of hours and days. Shopping when stressed, bored, and bored are examples of impulsive buying activities that someone needs to reduce.

How to Control Impulsive Buying

Create a Financial Budget

The first step so that you can control your impulsive spending habits is to create a financial budget. So, you can be more disciplined in spending your money. Make a financial plan each month detailing your specific needs. This includes your monthly income.

Furthermore, you can allocate mandatory expenses such as monthly expenses, insurance, installments, and others. Then, calculate the budget that you can allocate for entertainment, including shopping.

By making a budget, your spending will be more measurable because of the limitations. Adjust your expenses to your financial condition so that your finances are balanced.

Beware of Discount Season

The second is, as much as possible avoid opening a marketplace or visiting malls during the discount season. This is indeed difficult to do, especially considering the easy access to the marketplace today. However, that does not mean it is impossible to do. Because having a sale will actually lead to the temptation to buy things you don't need. As a result, you'll end up shopping outside your budget again.

Commitment

Last but not least, controlling impulsive buying can be done if you are committed and have the intention to be disciplined. Indeed, this is not easy to overcome, but that does not mean impossible. Remember that there are other long-term needs that must be met. Instead of spending on unnecessary things, it's better to save or invest, right?

Bring Cash, Not Credit or Debit Cards

Every now and then you can carry cash only without a credit or debit card when shopping. Before deciding to shop, we first have planned a list of what to buy and the estimated cost. Next, bring cash with an amount not far from the total cost of your shopping. With this habit, a person can have more control over which needs are really needed or not.

Refrain from Using Pay later Features

The pay later payment system actually makes it easier for us to meet financial needs, but keep in mind, that it's a good idea to use the pay later system only when there are urgent conditions. Do not use pay later to finance routine daily expenses or needs that are not really needed. Use a pay later if you are really in a state of financial difficulty, then you will avoid consumptive habits, especially in this impulsive buying case.

Several risks will arise if you are stuck in a consumptive habit using the pay later system, including the potential for defaults that result in fines and accumulated interest rates that continue to run.

Set Limits When Self-reward

Doing self-reward is highly recommended when you successfully complete the achievement that has been your goal for a long time. However, keep in mind that not all achievements require self-reward, especially with money. Giving self-reward can be considered from several conditions such as financial condition and how much you have achieved at that time. Don't use self-reward as a cover to satisfy your desire to have something.

So, those are some tips for controlling impulsive buying in the style of BFI Finance. Good luck, BFI friends!

If you need a loan for urgent needs, BFI Finance is the solution. Get a loan with a vehicle BPKB guarantee or a house certificate with a safe, fast process, and of course low interest.

#AlwaysAdaJalan to fulfill your various financial needs with BFI Finance.