Do you know how to make a personal finance book efficiently? As we know, recording all financial transactions during a certain period is an important thing that you shouldn't miss.

By doing this, it will be easier for you to achieve your financial goals and realize your financial resolutions this year.

So, how should we make a personal finance book? Here's how easy it is!

1. Financial Goals

Every individual has different financial goals. This can be influenced by the existence of different backgrounds, knowledge, culture, the surrounding environment, and upbringing (parenting).

One of the things you need to consider in how to make a personal finance book is to determine the financial goals you want to achieve. Although everyone has different goals, in general, financial goals include the following.

1.1. Manage Expenses Effectively

How to make a personal finance book is closely related to the desire of individuals to manage their finances effectively and in a more orderly manner. With a personal finance book, all forms of transactions that occur will be recorded and easier to trace, allowing you to set priorities, prioritize the most important expenses, anticipate a hedonistic lifestyle, cut unnecessary expenses, and of course gradually be able to achieve goals. long-term finance.

1.2. Ensure Financial Sufficiency

The most basic financial goal as well as the main goal of many people is to ensure that primary needs such as food, shelter, and clothing can be fulfilled. This is why having financial goals is very important so you can focus on the main goals that must be achieved, especially if you are already married and have children.

1.3. Financial Freedom

Who doesn't want to be financially independent or in other terms financial freedom? Everyone wants to reach this stage where they are financially stable, filled with security, and have no financial worries in the long term.

1.4. Adding Assets

Another financial goal is to increase the number of assets owned. Asset ownership is very important to maintain financial stability and increase one's income or wealth. To do this, you can try various ways, such as opening a small business, looking for passive income, adding investment assets, and various other ways that allow your income or wealth to increase.

1.5. Setting up a Pension Fund

Another important financial goal is setting up a retirement fund to ensure that you can live comfortably after retirement. Don't let your old age be burdened by debt and still mess around with looking for ways to get extra income.

1.6. Achieve Short Term Financial Goals

Humans are social creatures who instinctively have desires, both short and long-term. With these goals, you can motivate yourself to manage your personal finances even better. This is why you need to know how to make a personal finance book.

In addition to the six financial goals above, you can also set other goals according to your wishes and hopes that you want to achieve in the future. Most importantly, make sure the goals are not just black and white, but actually what you do. Remember, a little progress is better than big progress that is done inconsistently.

2. Types of Personal Financial Statements

The next way to make a personal finance book is to determine the type of personal financial report that you will make.

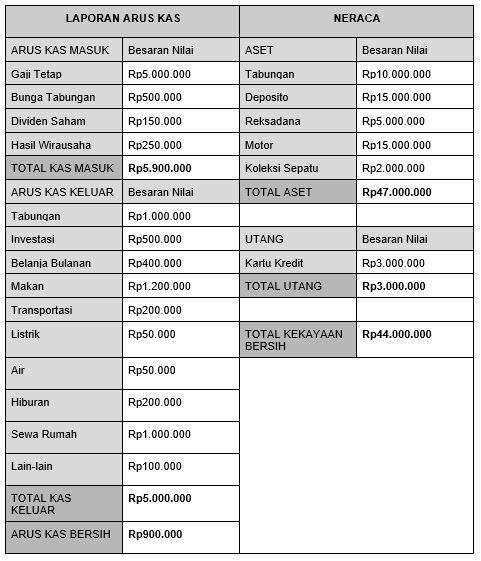

Personal financial reports consist of two types that you can choose according to your needs. Among other things, namely individual balance sheet financial statements and individual cash flow statements. So that you don't misunderstand the difference between the two, let's look at the following explanation.

Image Source: Pexels/Karolina Grabowska

2.1. Individual Balance Sheet

The following types of reports contain information on a person's personal wealth within a certain period of time. Starting from assets, net worth, to liabilities.

Important Points in Personal Financial Balance

-

Asset

Assets are valuable assets that are owned by individuals and can be converted into money. Assets owned by a person generally include cash or cash, tangible assets, intangible assets, liquid assets, fixed-income assets, and equity assets.

-

Liabilities

Liabilities are debt obligations that need to be paid to other parties according to the time or period agreed between the two parties. Some examples of liabilities include mortgage repayments, motor vehicle payments, credit card bills, and other loans.

-

Net Worth

Net worth is all the wealth owned by a person after deducting the value of existing debts.

2.2. Personal Cash Flow Statement

Unlike the personal balance sheet report, the cash flow statement contains a person's financial records from income to expenses. Everything is loaded completely within a certain timeframe.

The cash flow statement is divided into two. The first is the cash inflow report where the report contains records of income earned by a person. This income can be sourced from monthly salaries, wages, deposits, investment dividends, and so on.

The second is a statement of cash outflow which contains records of someone's expenses in a certain period. For example expenses for electricity bills, motorbike loans, monthly shopping, house rent, meal allowances, and many more.

Important Points in Individual Cash Flows

-

Cash Flow In

Cash flow is a record of income that consists of the various types of income sources that you have. Such as monthly salary, passive income, freelance, investment dividends, and so on.

-

Cash Flow Out

In contrast to incoming cash flow, in outgoing cash flow, the records contain expenditure transactions during a certain period. Existing expenses can be in the form of money for meals, rent for housing, mortgage installments, and much more.

-

Net Cash Flow

Net cash flow is a record of financial transactions that contains the remaining income from incoming cash flow minus outgoing cash flow. Net cash flow can be said to be positive if there is a difference between the two in which the remainder of the incoming cash flow is more than the outgoing cash flow.

3. How to Make a Personal Finance Book

After you know the types of personal financial reports and various financial goals, consider the following seven ways to make a personal finance book!

3.1. Set Financial Plans and Goals

Plan your financial goals such as wanting to save IDR 5 million in the next 3 months. Or want to invest 20% of your total income per month. After you determine your financial goals, arrange a plan to allocate your expenses and income every month, so that they can be controlled.

3.2. Use Notes on Mobile

How to make a personal financial book can be done briefly via cellphone. Use the notes or notepad feature to record simple details of expenses and income so you can control them.

3.3. Take advantage of Excel or Google Sheets

If you want to make a more detailed and neat personal finance book, you can use excel or google Sheets. You can create financial posts that contain all assets and liabilities that must be paid. Through these tools, calculating your financial expenses and income is also easier and faster.

3.4. Calculate the Entire List of Assets

After you create an excel file or google sheet link, you need to add an "Asset" financial post that contains all the wealth you have and not just cash. Other assets other than cash, for example, are stocks, mutual funds, motorized vehicles, gold, and others.

3.5. Calculate the Overall Liabilities or Obligations to be Paid

The next way to make a personal finance book is to enter a "liability" financial post that contains obligations that must be paid. Examples of liability instruments are all types of installments including credit cards or pay later if any, and monthly electricity and water bills.

3.6. Calculate Net Worth or Total Net Worth

After you make financial posts "Assets" and "Liabilities", then you can calculate the net worth or net worth that you have. The formula is total assets minus total liabilities. For example, if you have total assets of IDR 100 million with total liabilities of IDR 25 million. So, your net worth is IDR 75 million.

3.7. Keep a Daily Cash Flow Record

The last way to make a personal finance book is to make a cash flow statement or cash flow. The cash flow statement contains all sources of income that you have along with routine expenses for a certain period, for example, daily expenses for food, transportation, and others.

The cash flow statement will be positive if the total income is greater than the total expenses. Conversely, if your monthly expenses are greater than your monthly income, your cash flow statement will be negative.

4. Sample Personal Finance Book

Quoted from OCBC NISP, the following is an example of a personal finance book. You can use this example as a reference for making personal finances efficient.

Sample Personal Finance Book. Source: OCBC NISP

BFI friends, that's a discussion on how to make a personal finance book easily and effectively. Making a financial book is not easy, you need to adapt and build new habits. Even so, if you are consistent and sincere about doing it, you will feel the benefits in the future.

Easy and Secure Fund Loans

Need a fast liquid and secure loan? BFI Finance is here for you!

BFI Finance has been verified by OJK. By applying for a loan at BFI Finance you will get various benefits. Including the following.

BFI Finance is a company that provides multi-purpose loans with guarantees for motorbike bpkb, car bpkb, and house or shophouse certificates

Find other interesting information only on the BFI Blog. Latest articles every Monday-Friday!